By Christian Kaiser

By Christian Kaiser

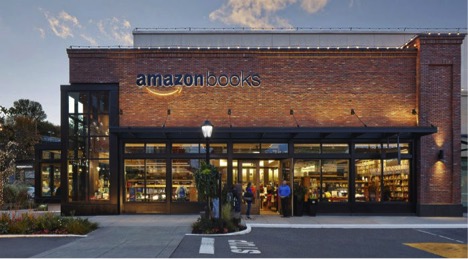

In late 2015, Amazon opened a physical bookstore in the University Village shopping center in Seattle. From what I can tell, it appears to be popular. My dad, an avid Amazon shopper, trekked over to check it out; it was “pretty cool.” However, there is something odd about this store, ignoring the irony of Amazon opening a physical bookstore, of course. The store does not accept cash as a form of payment. I have been to businesses that are “cash only,” but never “credit/debit” only.

According to §31 U.S.C. 5103, “Legal tender,” “United States coins and currency [including Federal Reserve notes and circulating notes of Federal Reserve banks and national banks] are legal tender for all debts, public charges, taxes, and dues.” This means all United States money is a valid and legal offer of payment for debts when tendered to a creditor, but there is no Federal statute mandating that a private business, person, or organization must accept currency or coins as payments for goods and services.

So, refusing cash is perfectly legal, but isn’t it annoying? Maybe. When was the last time you purchased a coffee with cash? Or a book, for that matter? Most purchases these days are done with a card. Amazon associates its in-store book purchases with your Amazon account if you use the same card you have on file with it. Forcing customers to use cards amounts to a fairly obvious big data play on Amazon’s part, but it is already doing this with online purchases anyway, so it is unclear how much Amazon stands to gain

Since the Federal Reserve does not mandate that private merchants accept cash, will other large retailers follow Amazon’s lead? Ultimately, like almost every decision in business, the answer probably comes down to cost. Will the cost of continuing to accept cash be outweighed by the purchases made with cash? Accepting cash costs money. A business has to store cash in registers and pay armored cars to ferry it to the bank. None of these costs exist with electronic payments, although the merchant must pay transaction fees. Furthermore, electronic payments are becoming increasingly popular and numerous. Perhaps in the near future so few people will use cash regularly that maintaining a system to accept it will become unjustifiable.

There are privacy concerns, however, with forcing consumers to use a form of electronic payment. Every purchase a consumer makes will be recorded in database at the corresponding financial institution. Currently, the Right to Financial Privacy Act of 1978 provides consumers with some protection against third party requests for their financial records. However, the exceptions chip away at the protections significantly. More recently, the Gramm-Leach-Bliley Act sought to provide consumers with more financial privacy, but it too is limited by many exceptions. It will be interesting to see if we continue our move towards a cashless society and whether consumers will demand new financial privacy legislation. Until then, if you want to buy a book secretly, maybe go to Barnes & Noble.

Image source: dlnws.com.